Contract Recoveries

Solutions to support your business strategies

Stay compliant with state and federal mandates

Responsibility and timelines for aftermarket cancellations vary by state. Determine accurate refunds and speed your rate of recovery. Learn More

Replace confusion with consistency

Our solution facilitates a streamlined process flow from initiating cancellations to determining accurate refunds to obtaining recoveries on behalf of consumers. Learn More

Give dealers their time back to sell

No longer rely on dealers to initiate cancellations and improve your rate of recovery, creating a win/win for all. Learn More

Solutions to support your business strategies

Select a challenge you face

Mitigate risk

Stay compliant with state and federal mandates

Responsibility and timelines for aftermarket cancellations vary by state. Determine accurate refunds and speed your rate of recovery. Learn More

Streamline the process

Replace confusion with consistency

Our solution facilitates a streamlined process flow from initiating cancellations to determining accurate refunds to obtaining recoveries on behalf of consumers. Learn More

Remove friction and maximize recovery

Give dealers their time back to sell

No longer rely on dealers to initiate cancellations and improve your rate of recovery, creating a win/win for all. Learn More

Put the power of cancellations and compliance in your hands

Exact Quotes

Pull in contract status and exact cancellation refund amounts directly from F&I product companies.

Incremental Cancellation

Automatically schedule and resend notifications when a refund is due, but payment has not been received.

Lookbacks (Review)

Improve recoveries on accounts that were terminated >180 days prior to your original cancellation date.

Why use Contract Recoveries

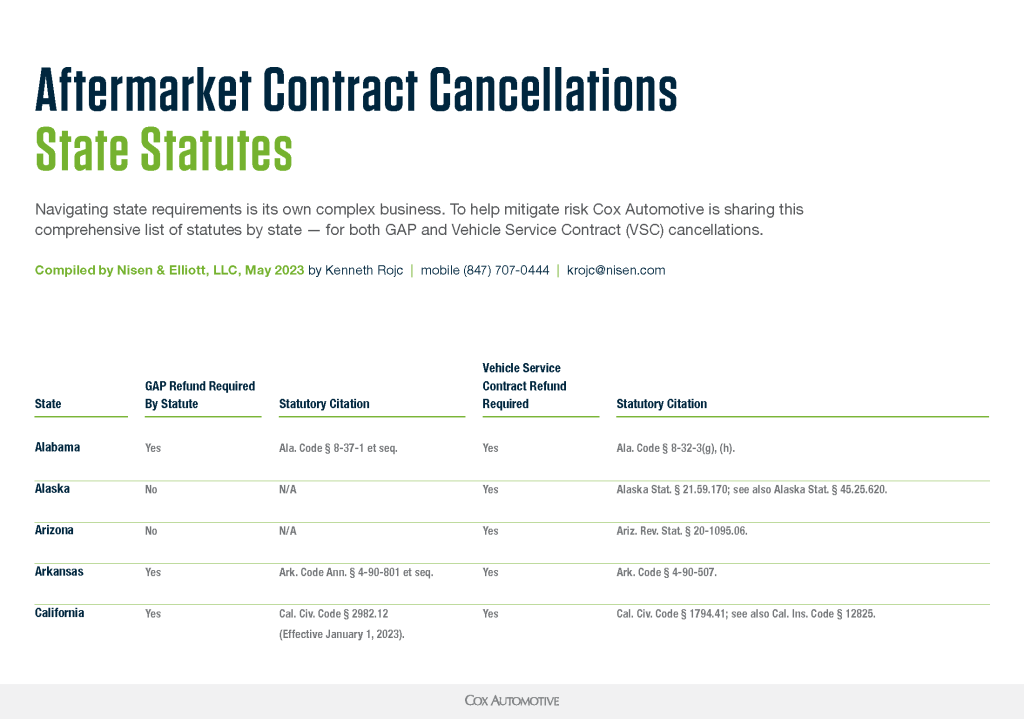

Aftermarket State Regulations

Discover which states make creditors responsible for refunding customers for GAP, Vehicle Service Contract and Credit Life in the event of cancellations.

Learn more about Contract Recoveries

Powered By Cox Automotive

Streamline operations and deliver high levels of service supported by Cox Automotive's solutions, partnerships and data. Dealertrack solutions help lenders gain efficiencies and compliance throughout the lifecycle of the loan.

Contact Us

Get started with Contract Recoveries

Set a 1:1 strategy discussion about developing an accurate and compliant aftermarket cancellation refund process.

Please note that this form is for lenders only.

Was this page helpful

Yes

No

Thank you for your feedback