Trends in Auto Loan Servicing No.7

Impact of Rising Delinquencies

Interview with Cox Automotive Chief Economist Jonathan Smoke

Get ahead of the trend

It’s in the news, repossessions are on the rise. But what does that mean for your loan servicing operation: cause to panic or time to prepare? Join Deshaun Sheppard and Cox Automotive Chief Economist Jonathan Smoke as they dive into this trend and a few others that will impact loan servicing this year.

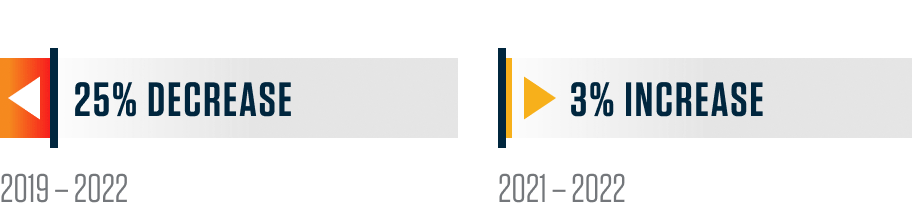

Return to normal: Repossessed vehicles

Deshaun Sheppard

Lenders Solution Expert

Accelerated Title is a free upgrade if we already manage your titles. Fill the form on the right if you’d like a call back — or set a meeting with me now: just open MY CALENDAR and pick your preferred date & time.

Past Articles

Trend No. 1

More

Negative Equity.

More Total Loss Transactions.

More Complexity.

More Total Loss Transactions.

More Complexity.

ARE YOU READY?

Since we already service your titles, optimizing your payoff & title release process is quick and easy.

Fill out the form or schedule a 30 min call with Deshaun now

Was this page helpful

Yes

No

Thank you for your feedback