Trade-In Titling

Trade-ins are a key pillar for every dealership’s used car business, but lien and title release delays can reduce profit potential as holding costs add up. This industry-exclusive solution expedites your payoff and title release process to help you speed inventory turn and improve cash flow for trades.

We know your challenges

Used vehicles sold by new-car dealerships are trade-ins.*

Handling trade-in volume

Maintaining used inventory levels requires constant, time-consuming calls to lenders for payoffs and lien and title release. But a digital solution helps make that workflow fast and efficient.

Average time it takes for payoff and title release.*

Lien and title release delays

Waiting for lien and title release means waiting to re-sell each vehicle. With a digital solution, lien and title release takes days instead of weeks.*

Average holding costs associated with lien and title delays.*

Accumulating holding costs

While you wait for lien and title release, overhead costs add up. A faster process can help preserve profitability on every trade.

Spent per rooftop in shipping & handling costs for checks on trade-ins.*

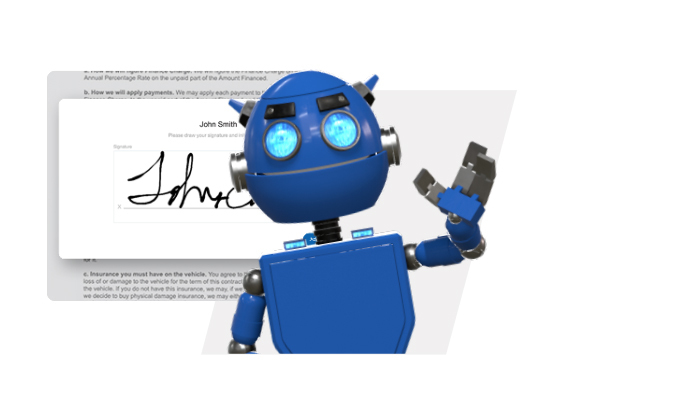

Spending too much time and money

The costs of cutting checks and shipping paper documents can really add up. A digital payoff and title release solution handles it all securely online with just a few clicks.

We know your challenges

Select a challenge you face

Inefficient used car intake

Handling trade-in volume

Maintaining used inventory levels requires constant, time-consuming calls to lenders for payoffs and lien and title release. But a digital solution helps make that workflow fast and efficient.

Trade-ins sitting idle

Lien and title release delays

Waiting for lien and title release means waiting to re-sell each vehicle. With a digital solution, lien and title release takes days instead of weeks.*

Maximizing trade-in profitability

Accumulating holding costs

While you wait for lien and title release, overhead costs add up. A faster process can help preserve profitability on every trade.

Costly manual processes

Spending too much time and money

The costs of cutting checks and shipping paper documents can really add up. A digital payoff and title release solution handles it all securely online with just a few clicks.

Trade-in titling savings calculator

Plug in your dealership’s numbers to see out how much you could save with faster payoff and title release.

How Dealertrack Accelerated Title® works

Trade-in transparency

View full title details ahead of accepting trades to avoid payoff surprises like undisclosed co-owners that can unwind a deal.

Reliable payoff calculations

Calculate reliable, date-specific payoff amounts without picking up the phone.

Faster lien and title release

Facilitate quicker payoff and lien or title release through 120+ lenders in a rapidly growing lender network.

Success with Dealertrack Accelerated Title®

It used to be we had to wait 30 days for payoff and title to clear before we could run a car through the shop and put it in front. Accelerated Title has made it faster and we can be more confident about getting the vehicle exposure quicker.

Delano, CA

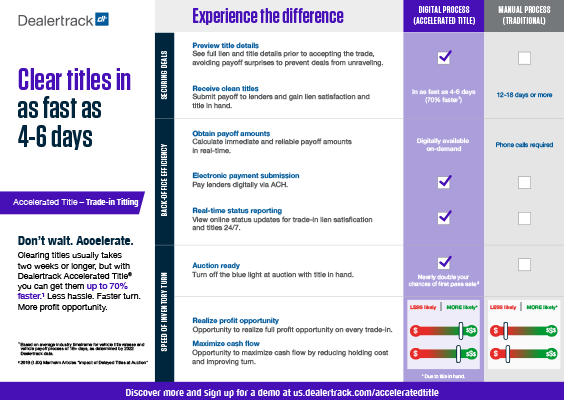

The Accelerated Title difference

Leaving your manual process behind and switching to a digital lien and title solution adds speed, reliability, and profit opportunity to your trades.

Digital Process (Accelerated Title)

Manual Process

Securing Deals

Preview Title Details

Receive Clean Titles

Back Office deficiency

Obtain Payoff Amounts

Electronic Payment Submission

Real-time Status Reporting

Speed of Inventory Turn

Maximize Cash Flow

Lenders on Accelerated Title

See the current list of lenders who help you turn trade-in liens and titles in as fast as 4-6 days.

Results

- 1st Advantage Federal Credit Union

- 1803 Capital (Edge Financial Services)

- Addition Financial

- Alliant Credit Union

- AltaOne Federal Credit Union

- Amarillo National Bank

- American National Bank

- American Credit Acceptance

- American Eagle Financial Credit Union

- American Heritage Federal Credit Union

- American Honda Financial Corporation

- AmeriCU Credit Union

- Andrews Federal Credit Union

- Aston Martin Financial

- Atlanta Postal Credit Union

- Avant LLC.

- Axos Bank

- Bank of the West

- BayPort Credit Union

- Bentley Financial Services

- BMO Bank

- Canvas Credit Union

- Capital One Auto Finance

- Cardinal Credit Union

- Chartway Federal Credit Union

- Chase Auto Finance

- Chrysler Capital

- Citadel Federal Credit Union

- Coastal Central Credit Union*

- Coastal1 Credit Union

- Coast Central Credit Union*

- Coastal Federal Credit Union

- CoastHills Credit Union

- Cobalt Credit Union

- Connexus Credit Union

- Consumer Portfolio Services (CPS)

- Consumers Credit Union

- Cornerstone Financial Credit Union

- Cinch Auto Finance

- Credit Union West*

- Crescent Bank

- Desert Financial Credit Union

- Dover Federal Credit Union

- Eagle Community Credit Union

- EECU

- Empower Federal Credit Union

- Enterprise Auto Finance

- Exeter Finance

- Farmers Insurance Federal Credit Union

- Fidelity Bank

- Fifth Third Bank

- First Commonwealth Bank*

- First Community Credit Union of Houston*

- First Financial Bank

- First Interstate Bank

- First Investors Financial Services

- First National Bank of PA

- Flagship Credit Acceptance

- Forum Credit Union

- Franklin Mint Federal Credit Union

- Frontier Credit Union

- Frontwave Credit Union

- General Electric Credit Union

- Georgia's Own Credit Union*

- Golden 1 Credit Union

- Great Southern Bank

- GreenState Credit Union

- Grow Financial Federal Credit Union

- GTE Financial

- Infiniti Financial Services

- Interra Credit Union

- iTHINK Financial Credit Union

- Jaguar Financial Group

- Kemba Credit Union

- KeyBank

- Lamborghini Financial Services

- Land Rover Financial Group

- Landmark Credit Union

- Langley Federal Credit Union

- Langley Lending Services

- Lentegrity

- Maserati Capital USA

- Mechanics Bank

- McCoy Federal Credit Union

- Members 1st Federal Credit Union

- Metro Credit Union

- MidFlorida Credit Union

- Navigant Credit Union

- Navy Army Community Credit Union

- Nissan Motor Acceptance Corp

- Northwest Federal Credit Union

- Nuvision Federal Credit Union

- OneMain Financial

- Orion Federal Credit Union

- Partners Federal Credit Union

- Pen Air Federal Credit Union

- Peoples Advantage Federal Credit Union

- PNC Financial

- Potlatch No 1 Federal Credit Union

- Porsche Financial Services

- Regional Acceptance Corporation

- Resource One Credit Union

- Rhinebeck Bank

- Robins Financial Credit Union

- Rockland Federal Credit Union

- Safe 1 Credit Union

- Santander Consumer USA

- Service Federal Credit Union

- Skopos Financial

- Southern Auto Finance Company

- Southland Credit Union

- Space Coast Credit Union

- Spokane Teachers Credit Union

- Security Service Federal Credit Union

- Self-Help Federal Credit Union

- Stellantis Financial Services Inc.

- St. Mary's Credit Union

- Strata Credit Union

- Strike Acceptance

- Subaru Motors Finance

- Suncoast Credit Union

- TD Auto Finance

- Teachers Credit Union

- Tennessee Valley Federal Credit Union

- Texas Dow Employees Credit Union

- Truist Bank

- Truliant Federal Credit Union

- UNIFY Financial Credit Union

- Union Bank & Trust

- Union Square Credit Union

- United Bank

- Valley National Bank

- Vantage West Credit Union*

- Veridian Credit Union

- Virginia Credit Union

- Vroom Financial

- Vystar Credit Union*

- Washington State Employees Credit Union (WSECU)

- Wells Fargo Auto

- Westby Co-Op Credit Union

- Westlake Financial

- Westmark Credit Union

- Wright-Patt Federal Credit Union

Learn more about Accelerated Title

Powered By Cox Automotive

Dealertrack is part of Cox Automotive, Inc., a global company dedicated to making buying, selling, owning, and using vehicles easier for everyone.

Get started with Dealertrack Accelerated Title®

We know you may want to see a demo. Choose your preferred demo experience below:

Take a Guided Demo

Experience an immersive demo of the Dealertrack F&I platform. Don’t worry – you can connect with your rep at any time!

Explore Now

Connect with your titling specialist

Set up time for a live demo of Dealertrack Accelerated Title® with your trade-in titling specialist.

Get In TouchPlease complete this form and your representative will contact you.

Was this page helpful

Yes

No

Thank you for your feedback